VR Bank Südpfalz is advancing digitization with a chatbot avatar solution

Together with CUX Gmbh, we have developed a combined chatbot avatar solution for the VR Bank Südpfalz eG for the digitization of customer dialogue and information query processes. It is thus expanding its digital service offering in a customer-friendly manner and giving its employees more time to use their advisory skills in a targeted way. In addition, the solution increases the potential for cost savings. VR Bank Südpfalz markets the chatbot solution as a product-as-a-service through CUX GmbH, which was founded with other VR banks.

The banking and financial services sector is changing rapidly. Customers are increasingly turning towards digital channels and expect personalized experiences around the clock with targeted solutions to their problems with short response times. The competition with pure online providers, whose processes and structures are geared towards digital service provision, is challenging for traditional banks. They have recognized the importance of digital service offers and the digitization of existing processes – and are therefore catching up.

Combine traditional strengths with new digital technology

"VR Bank Südpfalz naturally wants to expand its range of service in an innovative way and make it even more customer-friendly by combining its strengths with the advantages of digital technology", explains Patrick Morio, Managing Director of CUX GmbH. "It stands for a high level of competence and quality in advising customers in direct contact on site in the branches. We want to transfer this to the digital world." VR Bank Südpfalz identified a starting point in the area of real estate financing: The real estate market, which has been tense for years, demands short reaction times from interested parties and banks. Financing requests have to be processed quickly and answered with a specific offer. They identified the time-consuming, non-value-adding information retrieval and the data acquisition processes on the way to an individual offer as slowing factors.

The question arose as to whether a chatbot could relieve employees in these processes and give them more time for individual advice and the creation of needs-based offers for customers. For customers, the process should be decoupled from opening times and employee availability, and lead to the desired result more quickly. Basically, chatbots can be used to make dialogues with customers easier and more customer-friendly. "Properly integrated, they offer the opportunity to optimize business processes, reduce costs and bring general processes to the desired result for customers more quickly", emphasizes Julien Reinold, Consultant at ETECTURE.

Combination of chatbot solution and avatar

Against this background, together with VR Bank Südpfalz eG, we analyzed the processes and required information relating to real estate financing. It quickly became apparent that standardized processes that follow a specific scheme or checklists, such as those in the real estate finance sector, are well suited for a chatbot pilot project: They can be quickly and efficiently converted into an application. In order to achieve a more personal approach, we have developed a combined chatbot-avatar solution based on the open-source conversational AI platform Botpress. This solution collects all information that is necessary for the preparation of an individual offer for real estate financing. This relieves the employees of this burdensome task and gives them more time to use their advisory skills – and this is the basis for a high quality standard for discussions and offers in the further course.

Win-win situation for employees and customers

The employees in the real estate department grant customers access to the solution via a link sent by email. A cockpit for the consultants ensures transparency; you can see at a glance how far your customers are with the data acquisition. Once all the information is available, the financing experts can prepare optimally for the conversation with the customer and have an individual offer in place. The invitation by e-mail also has advantages for customers; you not only receive the link, but also an overview of the information and documents that will become important in the further course of the real estate financing process, as well as the general terms and conditions of the bank. This allows you to put everything needed together hassle-free and start data collection at any time via the link – to suit your own daily routine, completely independent of opening times and without travel efforts to a branch. After the survey, customers receive a summary and information about the next steps.

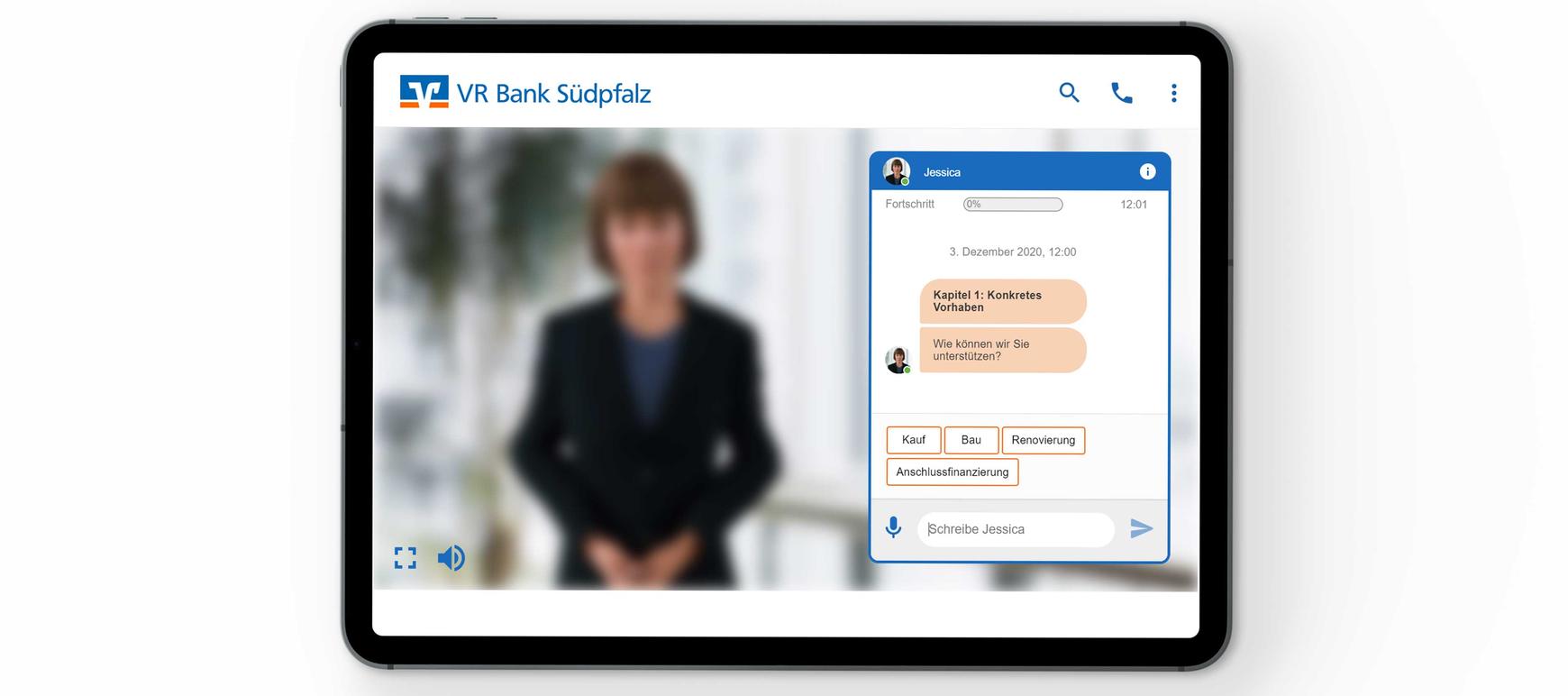

Personal communication, intuitive operation

As soon as customers start the data collection process via the link, Jessica, the avatar, introduces herself. After a personal greeting, she explains how the five-step process will work. She is also the one asking questions later on. "Answers can be entered manually using the chat function or selected from given options with a click of the mouse. Google chrome also offers the option of voice input", explains Julien Reinold. At the end of each step, customers receive a summary of their responses. You can correct your entries at any time. A progress indicator shows how much has already been done throughout the process. Customers can close the window in which the process is taking place at any time and come back later; the link from the email always leads to the last saved intermediate status. Once the data has been entered and saved, a summary is available as a PDF.

Convincing added value through digital solution

The customer data entered is automatically transferred to the banking systems by a software robot from VR Bank Südpfalz. In this way, not only the initial interview previously used to query information, but also the manual data entry by employees, becomes unnecessary. "The solution takes over all non-value-adding process steps. VR Bank Südpfalz can deploy employees in a targeted manner in value-creating, qualified tasks. At the same time, their motivation increases because we relieve them of time-consuming tasks", emphasizes Patrick Morio. The savings potential is also convincing: VR Bank Südpfalz can save 180 Euros per construction loan compared to the classic process. This converts into 150 Euros even if the offer is not accepted and another 30 Euros if the deal is successful. "Our chatbot avatar solution developed together with ETECTURE is not a contradiction to personal, individual advice, but a useful addition. We simplify the process steps upstream of consultation, disconnect the process from opening times and presence in a branch", continues Patrick Morio. "Through the use of technology, we are clearly strengthening our brand and increasing our customers’ satisfaction." The short implementation time is also particularly interesting: "We were able to develop a prototype based on the Conversational AI platform that was used within a few weeks, which had all the required functions. The time to go live is very short" adds Julien Reinold.

New business area through PaaS model

How satisfied VR Bank Südpfalz is with the result is shown by the establishment of CUX GmbH, a subsidiary that aims to open up an additional business area by marketing the solution as a product-as-a-service offering. "With ETECTURE we have developed a technical platform for dialogue-based acquisition of information that can be quickly integrated, scaled and adapted. The result is a multi-client avatar chatbot solution for digitizing customer dialogue and information query processes", underlines Patrick Morio, Managing Director of CUX GmbH.

Advantages of querying and collecting data with an avatar chatbot solution:

For the consultants:

- Relief from data and information collection – annoying time-consuming work is eliminated

- More time for consulting services and creating individual offers

- Control and transparency in the process at all times

- Overview of all inquiries, the progress of the data collection with customers and offers that are with customers

- Time saving through compressed preparation for personal on-site appointments

For customers:

- >Less journeys to the bank

- Acquisition and transmission of the necessary data regardless of time and place – easier adjustment to your own daily routine

- More targeted preparation

- An initial consultation that is felt to be unnecessary is omitted

For the bank:

- Increased efficiency and effectiveness in data acquisition processes

- Targeted use of resources in value-creating areas of responsibility

- Cost reduction in the overall construction financing process

- Enhanced employee motivation through more focus on qualified activities and relocation of time-consuming tasks

- Strengthening the brand through innovative use of technology

- Development of a new business area through scalable and adaptable, as well as multi-tenant technical platform for the digitization of customer dialogue and information query processes